Government bonds and their yields

In the face of global decline. stock quotes on the stock exchanges The debt market is increasingly attracting investors' attention, with its dynamics having a direct impact on changes in exchange rates on the international currency market.

In order to understand the mechanism of the impact of yield government bonds on currency quotes, it is necessary to refer to the basics of fundamental analysis.

Government credit and bond yields

The main form of government credit is currently the issuance of government bondsThe funds from the realization of which are used to cover the budget deficit.

Bonds, as a rule, are distributed among individual and institutional investors who wish to receive a guaranteed income. Initially, few people doubt that it will be paid, because the whole state acts as a guarantor. Nevertheless, such cases have happened and in order to prevent them, international rating agencies carefully rank countries by the degree of risk of investments in their credit products. The higher the rating, the lower the interest rate on the bond, i.e. the amount of debt that the government will have to repay.

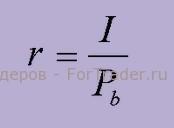

Private investors are guided by the size of bond yields (r), which in simplified terms is the ratio of income (I) to the exchange rate value (Pb):

Since the bond price and its yield are inversely correlatedIf the demand for debt securities increases, then the growth of demand for debt securities leads to an increase in their quotations and, accordingly, to a decrease in yields. Conversely, an increase in yields indicates a decrease in demand.